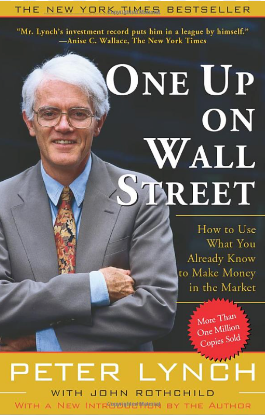

Author: Peter Lynch

“One Up on Wall Street” by Peter Lynch is a highly regarded book in the investing world. Published in 1989, it remains relevant for both novice and experienced investors. Here are some key takeaways from the book:

- Invest in What You Know: Lynch emphasizes that individual investors have an advantage over professionals because they can spot investment opportunities in their daily lives. By paying attention to the products and services they use, they can identify potential investments before Wall Street catches on.

- Long-Term Perspective: Lynch advocates for a long-term investment strategy. He believes that by holding onto stocks of well-performing companies, investors can achieve significant returns over time.

- Research and Understand Companies: Lynch stresses the importance of thoroughly researching and understanding the companies you invest in. This includes reviewing financial statements and understanding the business model.

- Ignore Market Predictions: According to Lynch, trying to predict market movements is futile. Instead, focus on the fundamentals of the companies you invest in.

- Look for “Tenbaggers”: Lynch introduces the concept of “tenbaggers,” which are stocks that can increase tenfold in value. Finding a few of these can significantly boost your portfolio’s performance.

Overall, “One Up on Wall Street” offers practical advice and insights that can help investors make informed decisions and achieve financial success.

Leave a Reply